Shawn Woods is president of Ashlar Homes LLC in Blue Springs, Missouri. This article is adapted and edited from testimony delivered last week on behalf of the National Association of Home Builders (NAHB) before the U.S. House Energy and Commerce Committee’s Subcommittee on Energy, Climate and Grid Security.

The primary and persistent challenge of the housing market is a lack of attainable, affordable housing in the single-family and multifamily markets, both for-rent and for-sale. According to NAHB’s Priced Out Estimates for 2024, 77% of households are unable to afford the median price of a new home, while according to Harvard’s Joint Center for Housing Studies, in 2022, half of all renters in the United States were cost-burdened households, paying more than 30% of their income on housing. Owning or renting a suitable home is increasingly out of financial reach for many households.

However, the lack of housing supply is not the only factor impacting housing affordability. Increased regulations, especially energy building code requirements, are making it harder and harder for home builders and multifamily developers to build housing that is attainable and affordable for American families.

Building Energy Codes

Although referencing model building codes in federal legislation and regulatory programs is not new, over the past few years, the breadth of programs and issues for which more stringent building codes are purported to be the answer is raising growing concern. This approach unfairly burdens and disadvantages new construction and often does little to meet the intended goals.

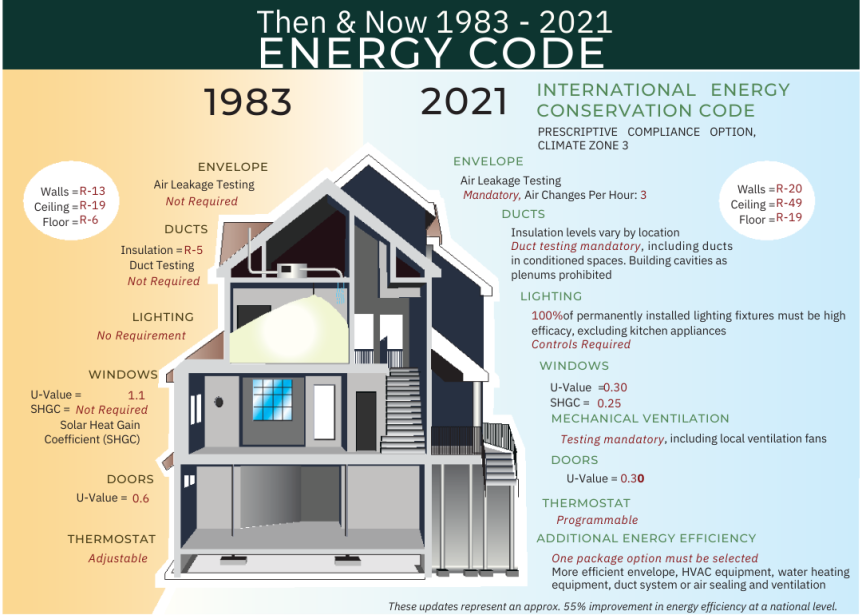

One of the most common approaches to increasing the stringency of energy codes, for example, is to simply require higher insulation levels in walls, floors, and ceilings. Unfortunately, most new homes are long past the point where additional insulation will be effective, resulting in a home that simply costs more to build. Similarly, the recent federal push to require certain new homes to meet the stringent energy efficiency requirements of the 2021 International Energy Conservation Code (IECC) will price many would-be home buyers out of the market and give them no choice but to stay in older, less efficient homes. The IECC is designed to serve as a model for state and local governments, who can choose to adopt or amend the various provisions based on their localized economies, consumer needs, climates, construction methods, hazards, etc.

The negative consequences of implementing a national energy code, with no consideration for local conditions, outweigh the minimal improvements to energy efficiency and is a misguided effort. At a minimum, federal policies and programs must provide sufficient flexibility and incentives so that the intended results can be met with minimal negative impacts.

Inflation Reduction Act Funding

The Inflation Reduction Act (IRA) provided $1 billion in grants for state and local governments to entice the adoption of costly and restrictive energy codes, namely the 2021 IECC or ASHRAE 90.1-2019. Two-thirds of the funds, or $670 million, will be made available for the adoption of energy regulations for residential and commercial buildings that meet the zero energy provisions in the 2021 IECC. This funding is overseen by DOE’s Office of State and Community Energy Programs.

While NAHB supports the adoption of cost-effective, modern energy codes, we oppose any federal funding that prohibits jurisdictions from adopting amendments to the energy code to accommodate local conditions and address cost-effectiveness concerns.

Modern energy codes are already incredibly energy efficient. Unnecessarily forcing the adoption of costly and restrictive energy codes to qualify for these grants will exacerbate the current housing affordability crisis and limit consumer choices while providing minimal benefit to the homeowner. According to Home Innovation Research Labs, compliance with the 2021 IECC can add $22,572 to the price of a new home, but in practice, home builders have estimated increased costs of up to $31,000.

Furthermore, it can take as long as 90 years for homeowners to see a payback from this investment. Most concerningly, compliance with the zero energy provisions of the 2021 IECC, where the vast majority of the IRA program funds are directed, adds up to $82,968 in additional costs per single-family home.

In addition to impacting potential home buyers, these increased requirements and higher costs can result in decreased production and longer permitting and construction times, further exacerbating housing affordability challenges. In the end, implementing these grants with these strict requirements will result in fewer families achieving the American dream of homeownership.

Furthermore, DOE has arbitrarily applied restrictions on the activities eligible for formula funding for these grants. DOE will not allow states to adopt amendments to the model codes – even if the amendments achieve equivalent or greater energy savings to the 2021 IECC or ASHRAE 90.1-2019. The stated reason for this restriction is due to the “complex nature of such combinations in both commercial and residential building energy codes, additional analysis will be required.”

The statutory language in the IRA clearly states that Congress’ intent in appropriating this funding is to assist states and local jurisdictions in adopting building energy codes that meet or exceed the requirements of the 2021 IECC or an equivalent energy code, yet DOE is further stripping away state and local control over the code adoption process through the implementation of this program.

Unfortunately, this energy code program already has had damaging effects on the housing market in my own community. Shortly after the IRA was passed, Kansas City, Missouri adopted the 2021 IECC without amendments in hopes of receiving these grant funds. The code went into effect on July 1, 2023. As a result of adopting these stringent energy codes, the Kansas City metro area, excluding Kansas City, has seen a 117% rise in single-family construction permits in January and February of 2024 compared to last year. Conversely, Kansas City has seen a 22% decrease in permits.

This is a move that has regrettably paralyzed the housing market in Kansas City at a time when area housing markets are booming. The resulting decline in homebuilding has had a domino effect on the rest of the economy, with fewer jobs, housing options, higher housing costs, and a lower tax base.

HUD and USDA’s Adoption of the 2021 IECC

It is not just the lure of federal funding that is being used to force the implementation of costly and unnecessary energy codes. In a move that will curb new construction and harm housing affordability nationwide, the U.S. Department of Housing and Urban Development (HUD) and U.S. Department of Agriculture (USDA) recently issued a final determination that will require all HUD- and USDA-financed new single-family construction housing to be built to the 2021 IECC and HUD-financed multifamily housing be built to 2021 IECC or ASHRAE 90.1-2019.

Without adequate review or consideration of how it will affect home buyers or renters, HUD and USDA have rammed through this mandate that will do little to curb overall energy use but will exacerbate the housing affordability crisis and hurt the nation’s most vulnerable house hunters and renters. HUD and USDA are supposed to help the most vulnerable home buyers and renters — not price them out of the housing market. This nationwide code mandate will significantly raise housing costs — particularly in the price-sensitive entry-level market for starter homes and affordable rental properties — and limit access to mortgage financing while providing little benefit to new home buyers and renters. It will also compel more buyers and renters to stay in their current, less efficient homes.

This ill-conceived policy will act as a deterrent to new construction at a time when the nation desperately needs to boost its housing supply to lower shelter inflation costs. Moreover, it is in direct conflict with the current energy codes of 44 states. This will lead to construction delays and a host of logistical and implementation challenges in the field, such as uncertainty as to how to comply, a lack of qualified inspectors, inconsistent appraisals, and confusion as to what mortgage products may be used to purchase any given home.

Federal Housing Finance Agency’s Consideration of the 2021 IECC

During the April 18, 2024, hearing before the U.S. Senate Committee on Banking, Housing, and Urban Affairs entitled “Oversight of Federal Housing Regulators,” Federal Housing Finance Agency (FHFA) Director Sandra Thompson confirmed that FHFA is considering applying the same standards recently adopted by HUD and USDA for new homes and apartments financed by Fannie Mae and Freddie Mac (the Enterprises). The Enterprises provide 72% of financing for new home purchases.

Therefore, any requirements established by the Enterprises largely dictate the rules for the housing finance market overall. This is true today for underwriting and appraisal standards. If FHFA were to move forward and require a specific energy code, it would become a de facto national standard.

Currently, building codes, including energy codes (which are just one component of the full suite of building codes) are adopted and implemented at the state and local level. If this model, which has been in place since the onset of building codes, is disrupted, it would eliminate the important flexibility that allows state and local governments to apply energy codes relevant to the unique needs of communities and homeowners in their jurisdictions and would have a significant and untenable impact on governmental oversight of new housing construction and the housing market broadly.

NAHB is particularly concerned that FHFA has not provided a compelling reason why the Enterprises should consider requiring new single-family and multifamily homes be built to the updated energy codes to be eligible for Enterprise financing, especially given that research has determined these codes are cumbersome and not cost effective.

The Enterprises were created to provide liquidity, stability, and affordability to the U.S. housing market. Any mandate by FHFA that limits the availability of Fannie Mae and Freddie Mac financing for new construction to only those homes that meet the 2021 IECC is counter to their charge and would severely disrupt the construction of new homes, exacerbate the housing supply shortage and negatively impact the affordability of newly constructed homes. Such a mandate would not only increase the cost of new housing but would also create conflict between mortgage program requirements and local energy codes since most jurisdictions have not adopted the 2021 IECC. Equally important, it would decrease affordable financing options for first-time and low- to moderate-income home buyers who want to purchase newly constructed homes and force them into the existing homes.

Appraisals

The appraisal process remains one of the major barriers to adding residential energy efficiency measures that have high upfront costs and long paybacks. NAHB notes that home builders have long expressed concern that upgrades, including energy efficiency enhancements, are often not accounted for in the appraisal. Requiring homes to be built to the 2021 IECC or other costly energy codes will not necessarily reflect current consumer demand and will, therefore, make it difficult for an appraiser to make an accurate assessment of market value.

Home buyers will have to pay much higher down payments when the appraised value does not fully include the increased costs. When an appraisal comes in less than the contract sales price due to upgrades, the borrower is required to pay the difference between the appraised value and the sales price. This places an additional burden on the home buyer, who may be unable to afford the out-of-pocket expense.

Older Homes

The American housing stock continues to age, and due to the recent decrease in production, there is increasing pressure to keep existing homes in service longer – homes that may not perform as well or be as efficient as newer homes. One hundred and thirty million homes out of the nation’s housing stock of 137 million were built before modern buildings took effect in 2010.

Equally problematic, the latest Census statistics show the number of homes built before 1970 that are taken out of commission is only about six out of every 1,000 being retired per year. These low rates of replacement mean that the built environment in the U.S. will change slowly and continue to be dominated by structures that are at least several decades old.

Older homes are less energy efficient than new homes. They were not built to the stringent requirements contained in modern codes, use (and lose) more energy, and often have less insulation and inefficient heating and air conditioning systems.

According to NAHB research, even though newer homes are larger, their average site energy consumption is often lower as a result of higher energy efficiency. While a typical U.S. household consumes 77.1 million BTU per year, households occupying units built since 2010 use 67 million BTU per year. Clearly, improvements in construction practices and building codes have made significant strides in reducing energy use in new construction.

However, the most cost-effective improvements have already been made, and further gains will be difficult and costly. In order to meet our national energy efficiency goals, many have recognized improvements must be made in all sectors and that retrofitting the existing building stock will be necessary.

According to the National Renewable Energy Laboratory, upgrades to the existing housing stock could yield a projected reduction of 5.7% of the total annual U.S. electricity consumption in 2030. Given this potential, coupled with the array of options and opportunities that exist to do so (e.g., replace/repair doors, windows, insulation, lighting, appliances; heating and cooling equipment, install energy management systems, heat pump, solar photovoltaics; window treatments, etc.) upgrades to the existing housing stock must be a primary focus if the nation is to make measurable progress.

Electrification and Gas Stoves

Concerns about the impacts of climate change have compelled policymakers at all levels to look for ways to cut greenhouse gas emissions (GHG) across all sectors of the U.S. economy. While there are many ways to achieve GHG reductions, many communities have supported passing laws or ordinances that effectively ban the use of natural gas and propane within new construction and existing homes. These efforts are concerning for several reasons.

First, although electrification may provide benefits in certain applications, electrification mandates can be costly and infeasible in some areas of the country and create challenges for builders, homeowners and consumers. For example, due to performance limitations of electric heat pumps in colder climates, the continued use of fossil fuel may be the only feasible option in certain circumstances and locations. Likewise, because electrification can result in both increased first costs and higher utility bills, electrification may place additional burdens on the consumer.

A study conducted by the Home Innovation Research Labs in 2021 found that the additional up-front cost to build an all-electric house (as compared to a house with natural gas equipment and appliances) ranged from $3,832-$15,100 depending on climate zone. Importantly, these estimates do not include fees for upgrading electric service or providing community electric infrastructure, which can be substantial.

Electrification policies can adversely impact energy supply and demand curves and consumer choice. The recent efforts by federal agencies to consider limiting access to gas stoves ignore consumer preferences and pocketbooks.

As home builders, we believe our customers have a right to choose the appliances and energy sources used in their homes. Over 187 million Americans currently use natural gas appliances, saving them an average of $1,068 each year.

Gas stoves are used in nearly 40 million homes nationwide and have proven to be a safe, efficient and affordable appliance choice for families for well over a century. The current push to regulate natural gas use will result in negligible health, safety, and energy outcomes but will drastically limit the ability of homeowners to install and use the appliances of their choice in their homes.

Credit/Source: This is a direct copy & repost

by | May 28, 2024 | Guest Opinion, News/Current Events, Real Estate News, U.S. Housing Market, WRE